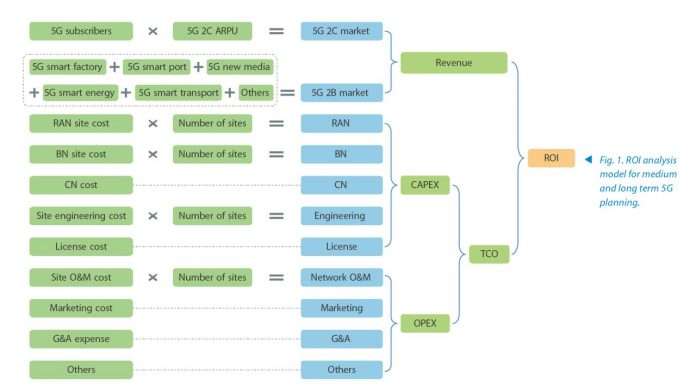

Building a ROI Analysis Model for Medium and Long Term 5G Planning

In a ROI analysis model for medium and long term 5G planning built by ZTE (Fig. 1), the revenue of operators in the 5G era comes from 2C and 2B, while the proportion of 2B revenue in the 2G/3G/4G era is negligible. CAPEX includes investment in network construction (including equipment and engineering) as well as license cost. OPEX involves network-related operation and maintenance (O&M) costs, and non-network-related marketing costs, general and administrative (G&A) expenses and other expenses such as international gateway fees and financial expenses, which are often listed in the operators’ annual report.

Case Study results:

The following is a case study of ROI analysis of the medium and long term (2020-2025) 5G planning for an operator in Southeast Asia, which is analyzed from three aspects.

1) Revenue: The operator’s 5G revenue comes from individual mobile business, FWA and vertical industries. According to the six-year forecast, the revenue from individual mobile business still accounts for more than 80% of total revenue, while 2B income is relatively low in the first three years and will gradually grow to over 20% after the fifth year. It can be predicted that 2B income will account for over one third of the total revenue in the long run. However, the revenue forecast of 2B industries is more uncertain than that of 2C business, which largely depends on the country’s macroeconomic development and the operator’s strategy.

2) CAPEX: The operator’s existing transmission devices are obsolete and have been put into use for a long time, most of which need to be replaced, so the investment in transmission is relatively high. As for the wireless network, reasonable KPIs are recommended to control the site size and a large number of co-site construction and infrastructure are shared, so the investment in wireless network can be well controlled, accounting for slightly over 70% of the total.

3) Financial indicators: From the perspective of 5G ROI alone, the pressure of cash flow is relatively high within six years. Cash flow does not turn positive until the fourth year, nor cumulative cash flow positive until the fifth year. However, the revenue from 4G business remains stable and can supplement 5G cash flow. The IRR of this project reaches 16%, and the static return cycle of 5G investment is 5.1 years, with a good overall evaluation.

More detailed analysis by ZTE with this link:

Benefit from Massive discount on our 5G Training with 5WorldPro.com

Start your 5G journey and obtain 5G certification

contact us: contact@5GWorldPro.com