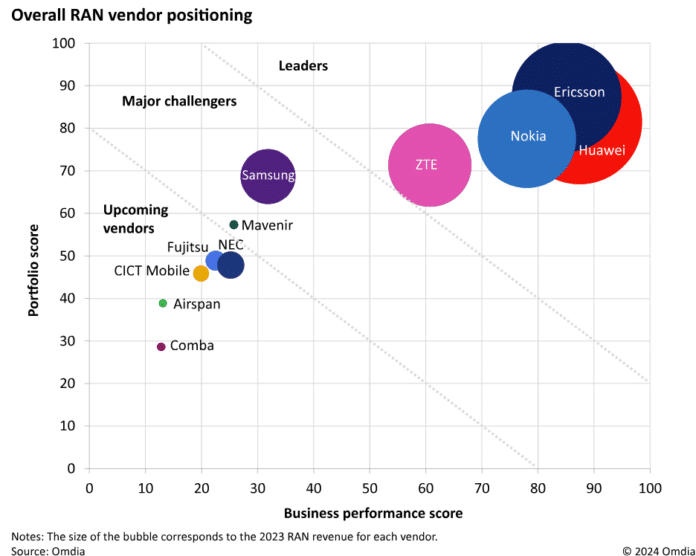

A fascinating report from Omdia, titled “Market Landscape: RAN Vendors 2024,” examines the market for RAN hardware and software specifically for macro base stations and small cells. While Open RAN and vRAN are included in the portfolio dimension, they do not affect the business performance dimension.

Omdia does not indicate a preference for open RAN or vRAN solutions over integrated purpose-built RAN solutions. The report focuses on two primary dimensions: RAN business performance and the breadth and competitiveness of the RAN portfolio.

- Ericsson is the leader in portfolio breadth and competitiveness, and it ranks second to Huawei in business performance. Ericsson’s notable strengths include a comprehensive radio portfolio, massive MIMO (mMIMO) products, and efficient baseband units. Huawei excels in business performance due to its high revenue market share and numerous deals, placing second in the portfolio dimension with strengths in radio portfolio, mMIMO products, and baseband capacity.

- Nokia ranks third in both dimensions. Its RAN solutions portfolio is robust, though not as extensive as Ericsson’s or Huawei’s. One of Nokia’s key strengths is its baseband. ZTE Corporation has risen to a leadership position in 2023 and continues to enhance its business performance through market share gains and new deals.

- Samsung Networks leads in open vRAN but has a less extensive portfolio compared to the top leaders. Mavenir, not featured in the 2023 report, appears as a major challenger in 2024 with a competitive portfolio centered on O-RAN solutions and a rich partner ecosystem.

Additionally, the report covers other significant vendors like NEC Corporation, Fujitsu, Airspan Networks, and Comba Telecom, which are influential in Open vRAN projects and the baseband portfolio.

Benefit from Massive discount on our 5G Training with 5WorldPro.com

Start your 5G journey and obtain 5G certification

contact us: contact@5GWorldPro.com